nj employer payroll tax calculator

Your employer uses the information that you provided on your W-4 form to. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

New Jersey Salary Calculator 2022 Icalculator

Payroll Tax Services generally do not pay these assessments for their clients.

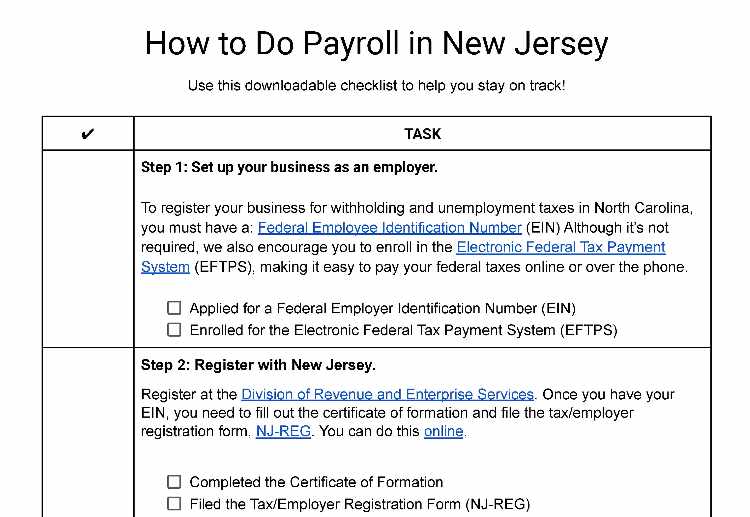

. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Employer Payroll Tax Electronic Filing and Reporting Options. Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W-3.

Rates range from 05 to 58 on the first. New jersey state tax quick facts. Rate information contributions and due dates.

Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W-3. Choose the calculator for your employer type to determine Choose the calculator for your employer type to determine your estimated Health.

Calculating paychecks and need some help. New Jersey New Hire Reporting. The party responsible for payment of assessments is the employer.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey. The standard FUTA tax rate is 6 so your max. Both employers and employees contribute.

Just enter the wages tax withholdings and other information required. Unemployment and Temporary Disability contribution rates in New Jersey are assigned on a fiscal year basis July 1 st to June 30. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Federal income taxes are also withheld from each of your paychecks. New Hire Operations Center. How Your New Jersey Paycheck Works.

Medicare 145 of an employees annual salary 1. Unemployment Insurance UI. In New Jersey unemployment taxes are a team effort.

Abacus Payroll and Alloy Silverstein present a summary of all the payroll tax changes that New Jersey employers or business owners need to know for the 2022 calendar. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. The new jersey payroll taxes new jersey is a little unique in that it charges a portion of the various payroll taxes to the employee as well as the.

New Jersey Salary Paycheck Calculator. Employer Payroll Tax Electronic Filing and Reporting Options. By law through assessments to all New.

The maximum an employee will pay in 2022 is 911400. Could be decreased due to state unemployment. New Jersey new hire online reporting.

Trump S Proposed Payroll Tax Elimination Itep

Employer Payroll Tax Calculator Free Online Tool By Incfile

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

New Jersey Household Employment Tax And Labor Law Guide Care Com Homepay

Surepayroll How To Calculate Payroll Taxes Youtube

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

Employer Payroll Tax Calculator Free Online Tool By Incfile

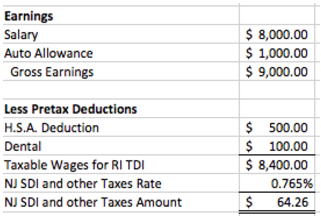

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Payroll Tax Rates 2022 Guide Forbes Advisor

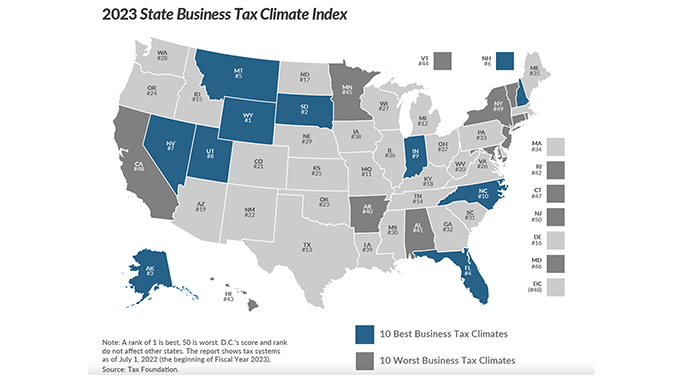

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

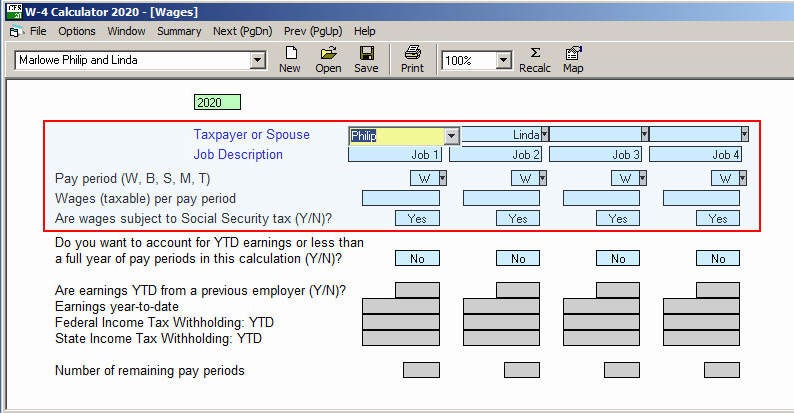

W 4 Calculator Cfs Tax Software Inc

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners